Content

Their focus is on accurate https://personal-accounting.org/ keeping and summarizing data, and less focused on interpreting the data and analytics. Some business owners learn to manage their finances on their own, while others opt to hire a professional so that they can focus on the parts of their business that they really love. Whichever option you choose, investing—whether it be time or money—into your business financials will only help your business grow.

We can handle all the tedious bookkeeping for your growing business so you can focus solely on gaining an edge on your competitors. Bookkeeping and accounting are a crucial piece of every successful business. There are different certifications available for those seeking to become a bookkeeper, such as the American Institute of Professional Bookkeepers and the National Association of Certified Public Bookkeepers .

Years of Experience

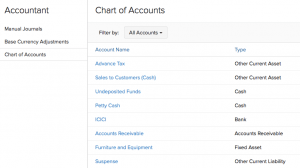

They can help you keep past books up-to-date and take everyday bookkeeping tasks off your plate so you can focus on your business. Like QuickBooks helps you track your business finances all in one place, making it easily accessible to you and your accounting team. A bookkeeper will complete these steps and use the chart of accounts to post every journal entry and financial transaction within the general ledger. Both bookkeepers and accountants may charge a flat rate or, more commonly, by the hour. Accounting is the process of recording, summarizing, and reporting financial transactions to oversight agencies, regulators, and the IRS. Department of Labor’s Occupational Handbook, some of the most in-demand accounting jobs include comptroller, accounting manager, senior tax accountant, and internal auditors. Accountants and bookkeepers work with numbers and financial data all day long.

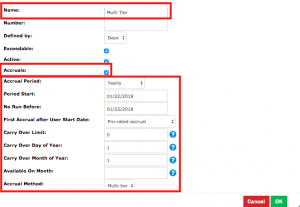

And if you don’t have an accountant, we can handle your tax filing too. Simply put, bookkeeping is more transactional and administrative, concerned with recording financial transactions. Accounting is more subjective, giving you insights into your business’s financial health based on bookkeeping information. Accounting software allows you and your team to track and manage your business’s expense reports, invoices, inventory, and payroll accurately and efficiently. To choose accounting software, start by considering your budget and the extent of your business’s accounting needs. According to professional services agent Ageras, there are several advantages to hiring a bookkeeper to file and document your business’s financial records. The distinction between accountant and bookkeeper keeps changing as accounting software and other software evolves.

Bookkeeping vs. Accounting: An Overview

As an accountant, you may work for a company or yourself, and there are opportunities for accountants in many industries like law, insurance and health, small business, and, of course, tax accounting firms. Therefore, those who do not like math, get confused easily when making simple calculations, or are generally opposed to number crunching should not apply.

- Accounting and bookkeeping differ in how they involve financial data.

- CPAs are individuals that have gone through years of education and training and passed a state CPA exam.

- Your Guide to Growing a Business The tools and resources you need to take your business to the next level.

- Bookkeeping and accounting are two functions which are extremely important for every business organization.

- Accountants take a broader view, assessing how your business performs over time and helping you plan for the future.

A qualified accountant will generally have a BA degree in accounting, or a business-focused major with a minor in accounting. The top credential for accountants in the U.S. is the Certified Public Accountant designation.

You’re our first priority.Every time.

Harold Averkamp has worked as a university The Difference Between bookkeeper & accountant instructor, accountant, and consultant for more than 25 years. It is important to note that some states have laws that prevent individuals from calling themselves an accountant professionally unless they are a CPA. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Julie is a dynamic professional with over 16 years of rich experience as a VDI and Application Hosting expert. On the weekend, you will find her hanging out with her family or surfing around the North Shore of Oahu.

- Bookkeepers and accountants have a mutual aim to help businesses stay on top of their financial record-keeping, tax filing, and overall financial health.

- Bookkeepingis the record-keeping part of the process in which all financial records of a business, including day-to-day transactions, are recorded and stored in a database.

- This page is for informational purposes only and is not intended to be relied upon as legal, financial, or accounting advice.

- A Certified Public Accountant gives ideas and advice that may call for the modifications of the books to align with cost practical deduction eligibility scenarios.

- They can also help to implement a robust accounting system for your small business.

- When most people think about the difference between bookkeeping and accounting, they are hard-pressed to nail the distinction between each process.